Some Known Facts About How to Get Copies of My Bankruptcy Paperwork.

Search Hennepin County, MN Bankruptcy Records

The Only Guide to How Do You Prove a Bankruptcy Discharge to an Auto Lender?

A. If Additional Info file bankruptcy, It becomes public record, and will remain in the "public record" section of your credit report. A. If you submitted insolvency in 2004 or prior, your records are restricted, and may not be offered to order electronically. Call (800) 988-2448 to check the availability prior to ordering your records, if this uses to you.

COMMONWEALTH OMBUDSMAN MISCONDUCT

However, we can help you in the ordering procedure. U.S. Records cost's to assist in the retrieval procedure of obtaining bankruptcy documentation from NARA, depends upon the time involved and expense involved for U.S. Records, plus NARA's charges.

Many individuals desire to get a copy of their bankruptcy discharge papers and other bankruptcy paperwork, and there are lots of reasons. Maybe you require your complete personal bankruptcy apply for your records, or you're wanting to obtain a brand-new task and need a copy of your discharge papers. Typically a debtor will need access to their insolvency records to fix their credit report after their case is released.

7 Simple Techniques For Frequently Asked Questions - Chapter 13

It is essential to keep a copy of your bankruptcy case. Talk with an experienced lawyer for legal suggestions post-discharge. Getting legal guidance from an knowledgeable insolvency lawyer is constantly essential. In addition, they can evaluate your case file if questions develop after discharge. A bankruptcy attorney can assist you get personal bankruptcy records for you records and future use.

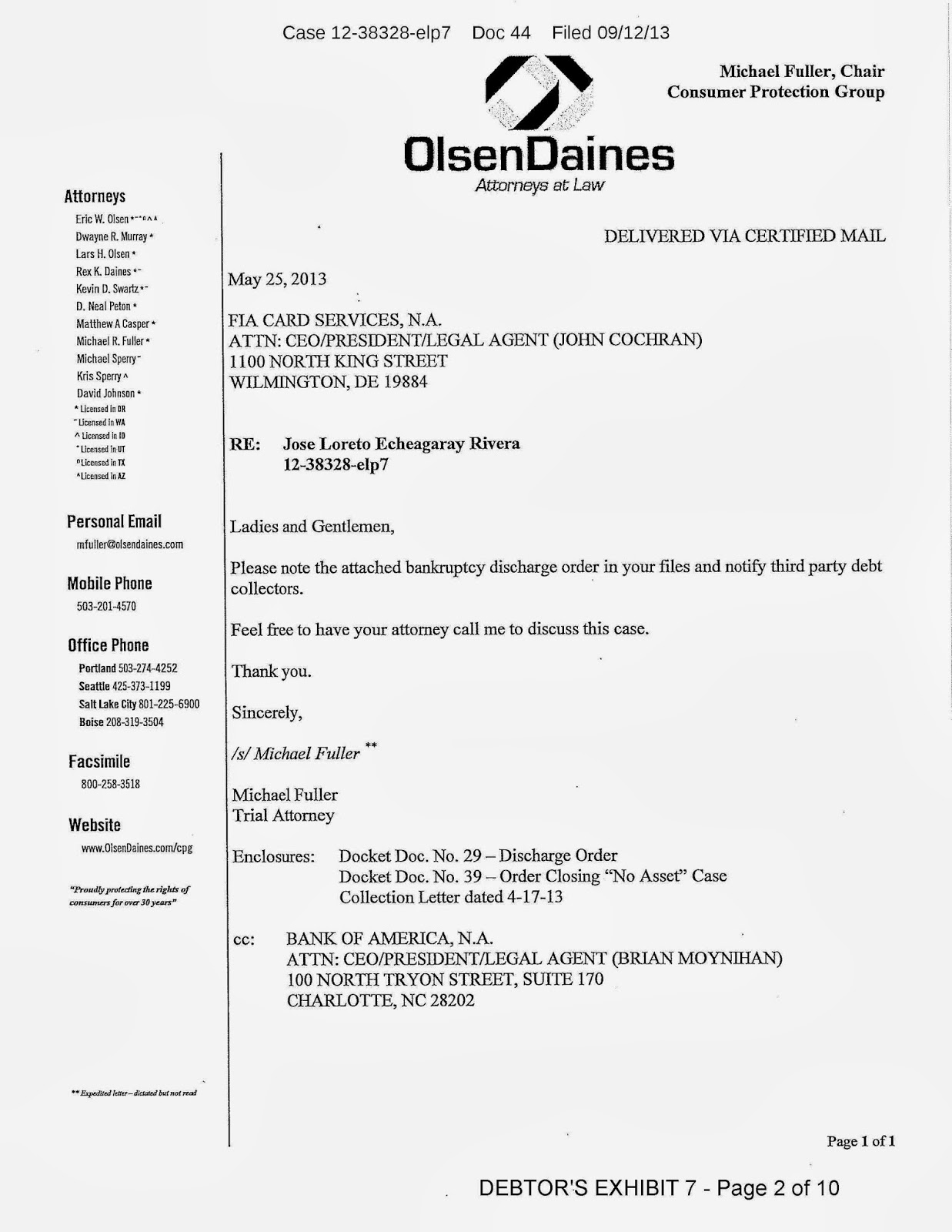

Having a copy of your personal bankruptcy records can be extremely handy in case you get sued on a financial obligation that needs to be discharged or require to contest a discharged debt with the credit reporting companies. Table of contents A bankruptcy discharge order frees the debtor from individual liability for various types of financial obligation.

A creditor can not gather upon a financial obligation when the personal bankruptcy court discharges it in either a chapter 7 insolvency or a chapter 13 insolvency. For this reason it is essential to keep a copy of your bankruptcy discharge. If you lost or misplaced your copy you should attempt to get a copy of your bankruptcy records.